Tandia Investment Shares

Benefits of a long term rate without the commitment

Benefits of a long term rate without the commitment

Benefits of a long term rate without the commitment

Tandia Investment Shares are an exclusive investment opportunity only available to our members. These shares offer members the potential to realize an excellent rate of return while helping build the Credit Union’s capital base for future growth.

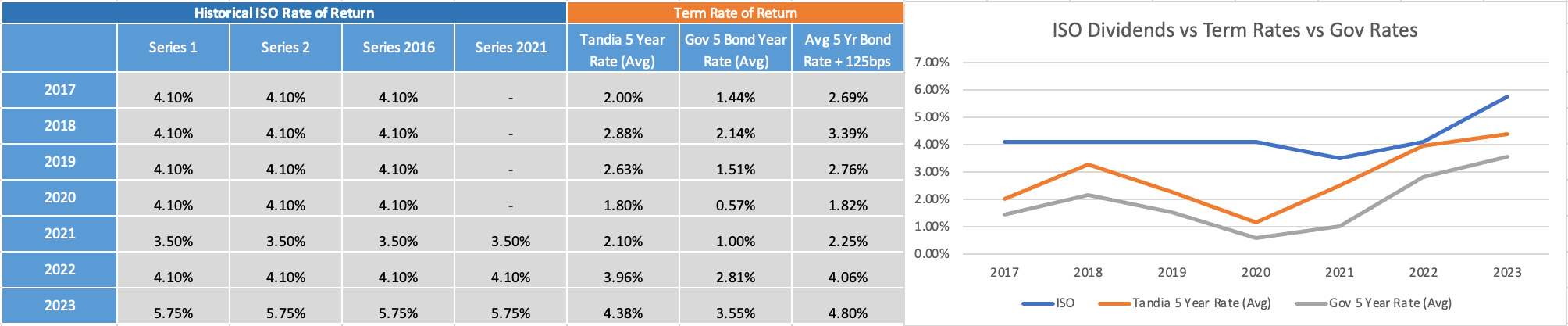

Tandia Investment Shares have historically had a high rate of return with annual dividends being paid to shareholders. They are a safe, secure investment that is not impacted by market volatility. Your investment helps make Tandia stronger and offers you peace of mind knowing that we are committed to our community and members.

Our current declared investment shares dividend rate as of January 15th 2024 is 5.75%. Our current 5 Year Term Deposit rate is 4.20*.

* Current 5 Year Term Deposit Rate is valid as of January 15th, 2024 and is subject to change without notice.

While previous releases of Investment Shares have closed, members can avoid missing out on future releases by adding their names to a waitlist where they can acquire Investment Shares through a transfer from another member*.

For more details on how to be added to the Investment Shares waitlist or to redeem, please visit your local branch or contact the Member Solutions Centre.

*Investment Shares are not an ongoing investment offering, however, periodically existing Investment Shares are redeemed and become available for sale. When offered, Investment Shares are sold for a limited period, on a first-come, first-served basis and are TFSA, and RRSP eligible. Investment Shares are securities that are non-cumulative, non-voting and non-participating. It is important to note Investment Shares are not eligible for insurance by the Financial Services Regulatory Authority (FSRA). As well, the dividends are not guaranteed.

Investment Shares are considered capital of the Credit Union and as such, redemption is limited and subject to regulatory conditions. The Credit Union can only redeem a maximum of 10% of total eligible Investment Shares each year.

Dividends are declared by the Board of Directors each December. Dividends may be reinvested in additional shares or paid out as cash. The Offering Statement for each Series provides full details.

Yes. If a member makes a request to sell their Shares or indicates interest in purchasing additional shares, abiding by Board policy, Tandia will attempt to accommodate these requests by matching members who want to sell with those who are interested in purchasing. Shares may be transferred between Tandia members only.

Tandia cannot guarantee that it will be able to facilitate any transfer requests. To initiate the sale or transfer of Investment Shares or to request the purchase of available Investment Shares from an existing Series, please visit your branch or contact the Member Solutions Centre.

Both RRSP and TFSA funds are eligible for Investment Shares. RRIF funds are eligible too – please speak to a Member Solutions Advisor to determine the best plan for including Investment Shares in your RRIF portfolio.

Investment Shares are typically purchased by members with a long-term investment horizon. Members who originally purchased Investment Shares were subject to a minimum five year term. Members who wish to redeem or transfer their Shares may do so after the initial five year term, subject to the parameters detailed in the Offering Statement.

Members receive a T5 for reporting interest income annually.

Yes, ‘Details of Investment Shares’ for each Series along with the amount are included in your regular Tandia statements.

At Tandia we have a range of investment products that can help you reach your financial goals. We have a full complement of traditional investment products that can be held within or outside of a registered plan.

No matter what stage of life you are in or how much money you have to invest - we are here to work with you and help your savings grow.

Giving back generously to our community to make a positive financial, social and environmental impact is an important part of what Tandia stands for.

Listen to our weekly Podcast that answers all your burning questions about money. We’re here to make money more relatable, with take-action tips to help you create the life you want.

We will help you tackle those financial problems, look at your goals and help you define your financial journey. Start listening!

That means you can be confident that your unique needs come first. We understand that everyone is different, and we tailor solutions that are just right for you. Our values prove it.

Our representatives are ready-when-you-are to help with investment questions, advice and solutions. We can meet you where and how you want to meet. We are available by email, by phone, in person, or by video conferencing.

Get in touch with us at any time, whether it’s a question about our services or a comment on how we can do things better. Your voice is number one at Tandia.

To report a lost or stolen MEMBER CARD® debit card during regular business hours, call 1-800-598-2891 after hours please call 1-888-277-1043.