Market Insights

Keep informed about what's happening in the financial markets

Keep informed about what's happening in the financial markets

Data and opinions as of November 30th, 2025

November 2025 saw global markets rally on easing inflation and resilient earnings, though volatility persisted as investors weighed record S&P 500 net margins and earnings growth against sustainability concerns. The S&P 500 Index posted the 7th consecutive month in gains, the longest since August 2021. Cyclicals outperformed defensives, while AI mega‑caps remained central to gains, although Nvidia slipped 11% amid bubble fears and rising competition. Bond markets priced in a sharply higher probability of a December Fed rate cut after dovish signals from policymakers, weaker consumer confidence, and moderating inflation, driving Treasury yields lower. Equities initially surged on rate‑cut optimism but later pulled back, with the VIX climbing above 23 as credit spreads widened and geopolitical risks resurfaced. Regionally, Asia outperformed on tech strength, Europe lagged with cautious monetary stances, and emerging markets delivered mixed results. Overall, November highlighted both the opportunities of AI‑driven productivity and the fragility of valuations, leaving investors balancing optimism with caution heading into year‑end.

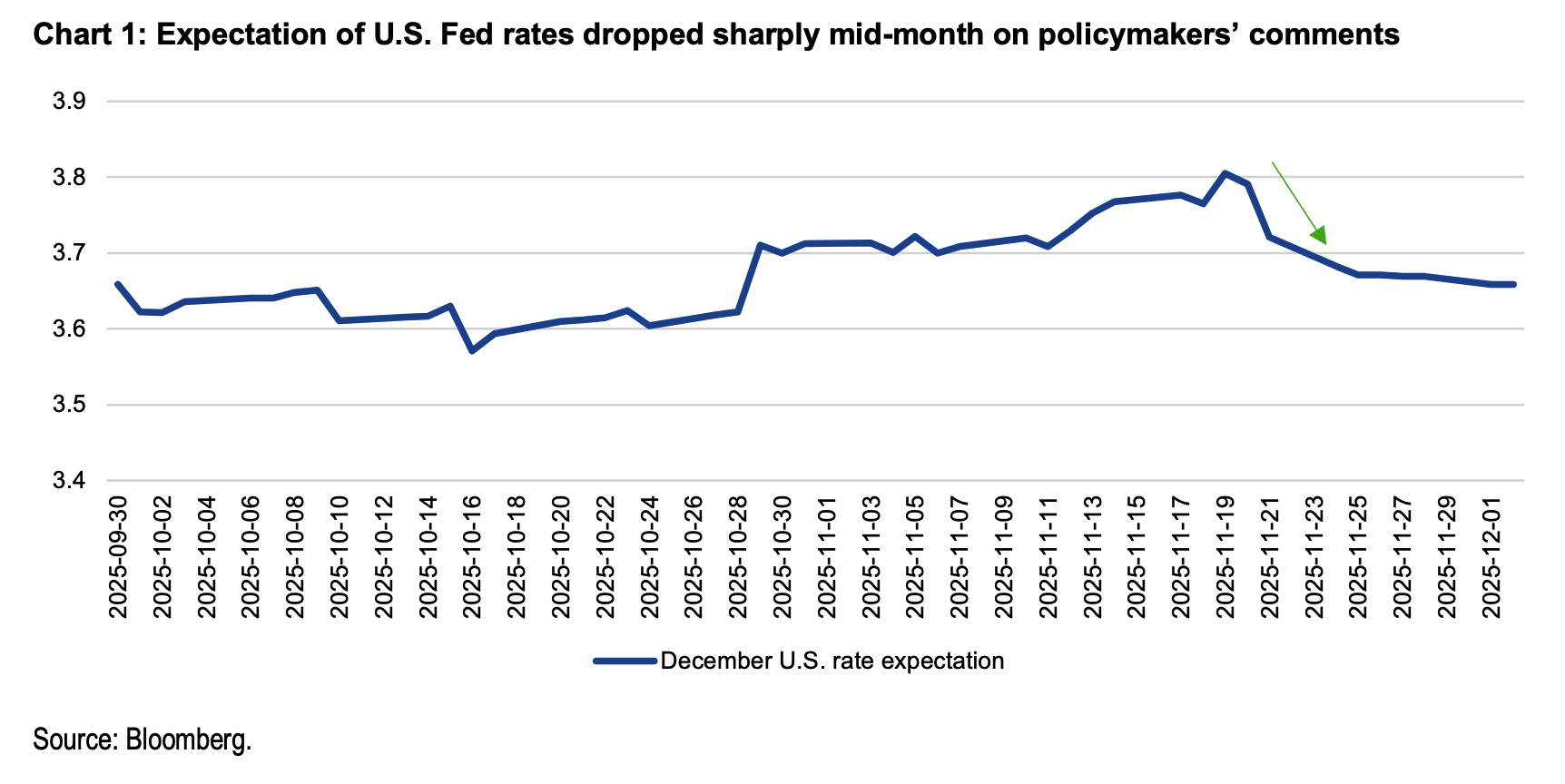

Prospects for December rate cut increased by mid-month, alleviating market jitters: RFederal Reserve (Fed), officials’ dovish remarks sharply increased the likelihood of a December rate cut, boosting market optimism. Bond yields fell and equities rebounded, but gains faded amid investor fatigue and rising credit risks. Corporate spreads widened, then narrowed to near-decade lows as caution gave way to renewed confidence.

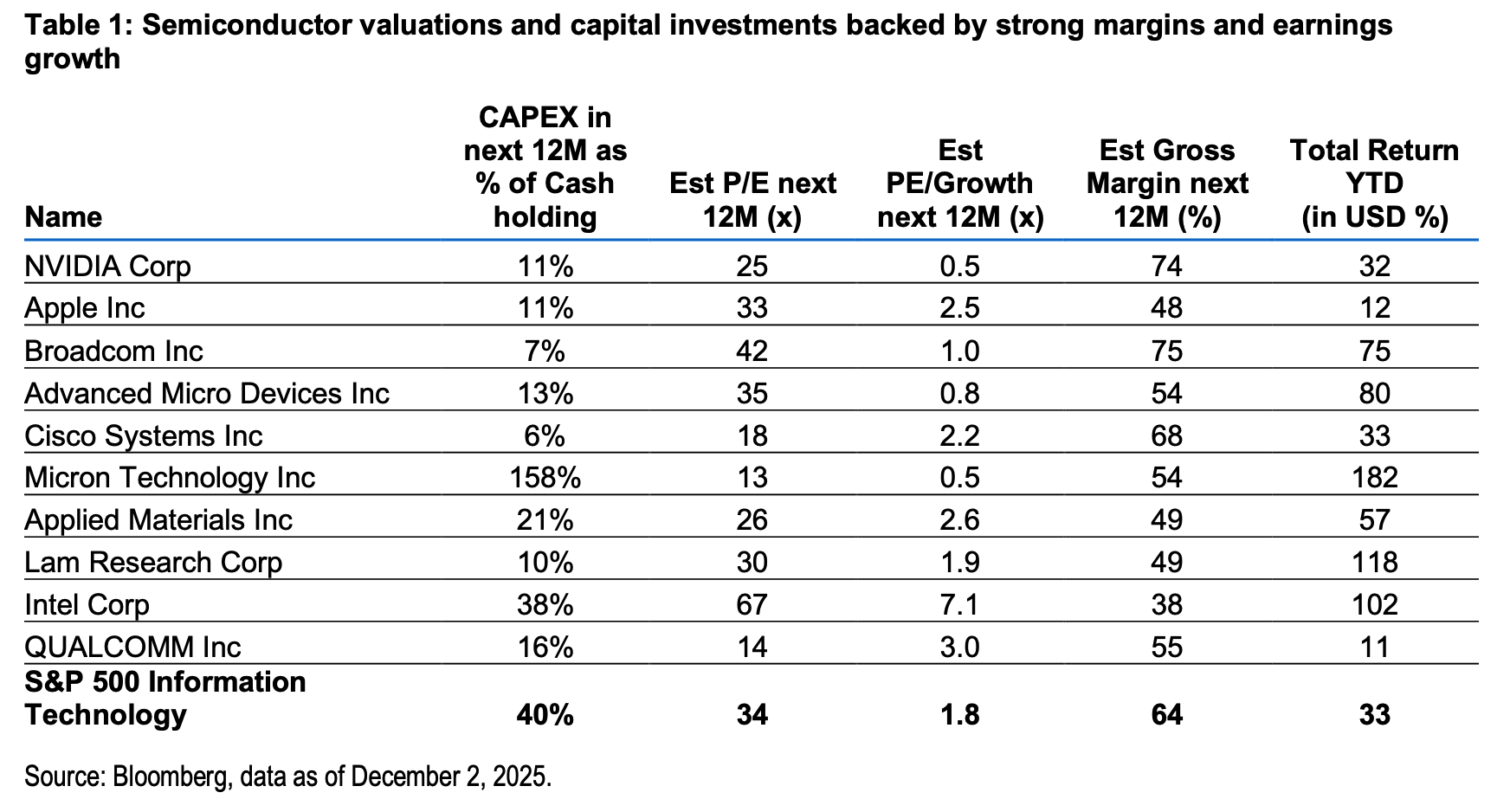

AI mania and strong Q3 earnings delivery: November 2025 saw rapid AI innovation with major model releases, large-scale partnerships, and record funding. Despite investor concerns about sustainability and bubble risks, AI spending and sector growth remain robust, supported by solid earnings and falling interest rates. The markets saw investor fatigue, citing the increased use of bond issuances to fund expansion and circular partnerships between hyper scalers as risk factors. Bottom line: Investors can benefit from rapid AI growth by diversifying across tech, infrastructure, and related real estate like data centers and energy assets, while steering clear of overvalued sectors.

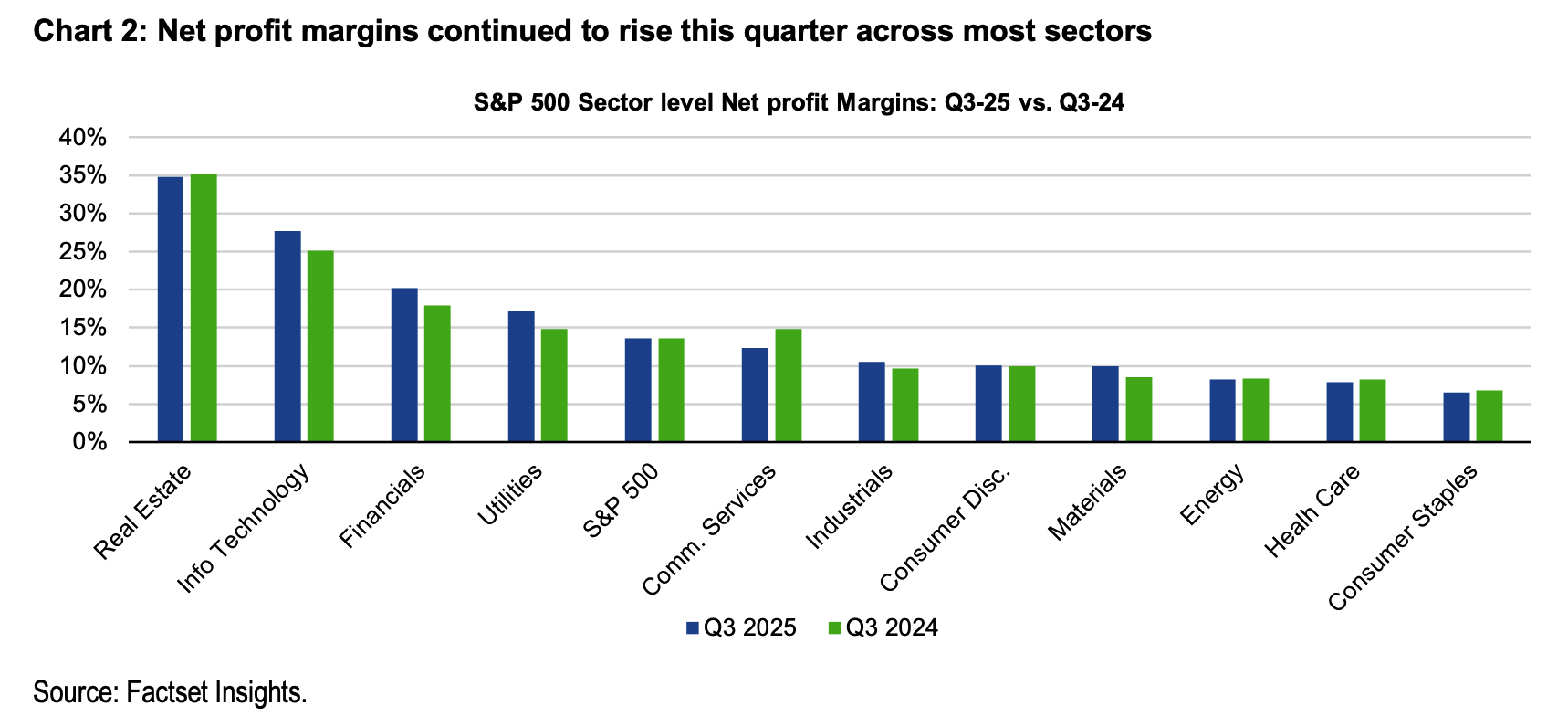

Resilient earnings growth despite trade and rates uncertainties: U.S. companies reported record growth in revenue and net profit margin, despite tariffs and rising costs. S&P 500 returns were largely driven by earnings growth, especially in technology and semiconductor sectors, aided by AI-driven productivity. Companies maintained pricing power, though income disparity is raising concerns about the durability of consumer-led growth. While record margins signal strength, long-term sustainability remains challenged by structural pressures. Bottom line: Investors should stay positive yet cautious—capitalize on AI growth but manage risks by diversifying globally into defensive areas.

‒ NEI Asset Allocation team

Fed Governors Christopher Waller and John Williams made remarks suggesting openness to near-term easing of interest rates, which lifted the December rate cut probability dramatically from 35% to over 80% in mid-November. Chairman Powell’s tone also softened, signaling flexibility in response to evolving conditions. Major banks also shifted their forecasts toward a December cut, reinforcing market conviction. The shift in tone came amidst declining U.S. consumer confidence, slowing but resilient labour market momentum, and sticky but easing inflation measures, giving the Fed room to cut without reigniting price pressures.

The bond markets rallied on this shift in signals, with yields falling, while equity markets initially surged from mid- month lows on rate-cut optimism. The U.S. markets recovered to end the month almost flat, the optimism waned as investors showed fatigue, weighing credit risks and valuation pressures and volatility surged. Corporate credit spreads widened as investors grew cautious about downgrades and rising leverage, before tightening again towards the end of the month back to be close to decade low of 72bps

November 2025 was a defining month for AI, with new frontier models, multi-billion-dollar partnerships, and growing scrutiny over risks and valuations. Competition is at breakneck speed as hyper-scalers including OpenAI (launched GPT 5.1, a significant upgrade focused on multimodal reasoning and agent capabilities), Anthropic (released Claude Opus 4.5, optimized for coding and advanced reasoning tasks), Google (unveiled Gemini 3 Pro, competing directly in multimodal AI, especially video and content generation), and DeepSeek (introduced Math V2, the first open-source model to achieve International Mathematical Olympiad gold medal-level performance, marking a breakthrough in mathematical reasoning), launched new models of their AI models.

On strategic partnerships, OpenAI and AWS announced a $38B partnership, expanding AI infrastructure and cloud integration. Nvidia hit a $5 trillion milestone week, with a historic deal to supply 260,000 Blackwell AI chips to South Korea’s sovereign clouds and AI factories. Over $3.5B in AI funding flowed into startups, highlighting continued investor confidence despite bubble concerns.

The sector is expanding rapidly, but investors are fatigued as questions about sustainability of growth and regulation are intensifying. Nvidia’s stock shed 11% in November, dented by competition from Google and fears of an AI bubble. Analysts compared the AI boom to the dot-com bubble, citing the increased use of bond issuances to fund expansion and circular partnerships between hyper scalers as risk factors. Analysts, however, also noted that, unlike the 2000s, interest rates are expected to fall, lowering the cost of financing, while these companies are also delivering solid near-term earnings with a clear trajectory of growth and margins, which are supportive of strong valuations. Despite volatility, AI spending is not slowing down, with analysts projecting continued growth across sectors

Bottom line: Investors should be mindful of diversification while capturing the explosive growth in AI opportunities. Diversification within the sector can be obtained through layers of exposures between direct tech

exposure, data infrastructure, and infrastructure real estate such as data centers and energy assets to capture the backbone of AI growth while avoiding direct valuation bubbles.

For Q3 2025, U.S. companies reported the highest revenue growth of 8.4% in three years, and the highest net

profit margin at 13.1% in over 15 years. This marks the 7th consecutive quarter of increases, showing resilience despite tariffs, higher input costs, and wage pressures. Profitability has been a major driver of S&P 500 returns in 2025, with more than half of gains attributed to earnings growth, much higher than investors have anticipated.

While it is still widely debated how much AI adoption has boosted productivity, the technology and semiconductor segment has clearly been a contributor to strong growth on margins. Despite concerns on the bifurcation of consumers’ ability to spend between the top income earners and lower-income earners, companies in consumer discretionary and tech sectors have maintained strong pricing power. This bifurcation, however, is fueling broader concerns about the sustainability of overall consumer-driven growth and increasing pressure on sectors dependent on mass market demand.

Investors are celebrating record‑high margins and earnings as a sign of corporate strength, but sustaining these levels will be difficult. AI‑driven productivity and pricing power may keep margins elevated in the near term, but structural pressures could cap or reverse gains over the longer horizon.

Bottom line: Investors should stay constructive but disciplined. Embrace AI‑driven growth and easing inflation tailwinds, while being cautious about margin sustainability risks and geopolitical uncertainty by diversifying into defensive sectors, and maintaining a global portfolio.

Data and opinions as of November 30th, 2025.

Aviso Wealth Inc. (“Aviso”) is the parent company of Aviso Financial Inc. (“AFI”) and Northwest & Ethical Investments L.P. (“NEI”). Aviso and Aviso Wealth are registered trademarks owned by Aviso Wealth Inc. NEI Investments is a registered trademark of NEI. Any use by AFI or NEI of an Aviso trade name or trademark is made with the consent and/or license of Aviso Wealth Inc. Aviso is a wholly-owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by AFI and unless indicated otherwise, all views expressed in this document are those of AFI. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information. Mutual funds and other securities are offered through Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

©2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar Research Services LLC, Morningstar, Inc. and/or their content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar Research Services, Morningstar nor their content providers are responsible for any damages or losses arising from any use of this information. Access to or use of the information contained herein does not establish an advisory or fiduciary relationship with Morningstar Research Services, Morningstar, Inc. or their content providers. Past performance is no guarantee of future results.

Absolutely not, anyone can benefit from solid investment advice! Even if you are just starting out, speaking with a Wealth Advisor about your unique goals and situation is a great way to get started. Having an investment plan in place can help you reach your life goals, like retirement or buying a home, while giving you peace of mind about your investment choices. We can’t all be experts, right? So why not benefit from a little advice and guidance from those that are!

You don’t need to be an expert to know that the Canadian economy has been unpredictable and has a lot of people on edge right now – but why is that, and what exactly does it mean for you? Well, we are here to help you find out! Think of this article as your own personal cheat sheet to help you better understand some of the terms you’ve heard recently, why this is such a hot topic right now and what impact it may have on you.

Money Mindset is a collection of bite size easy to understand articles, tips and resources where we delve into the world of finance, promote financial literacy, and empower individuals to gain a better understanding of their money and how it works.

At Tandia we have a range of investment products that can help you reach your financial goals. We have a full complement of traditional investment products that can be held within or outside of a registered plan.

No matter what stage of life you are in or how much money you have to invest - we are here to work with you and help your savings grow.

Tandia has specialized investment products and services that are customized and tailored for business clients. This includes accounts for community and non-profit organizations. Let us help you grow.

Our representatives are ready-when-you-are to help with investment questions, advice and solutions. We can meet you where and how you want to meet. We are available by email, by phone, in person, or by video conferencing.

Get in touch with us at any time, whether it’s a question about our services or a comment on how we can do things better. Your voice is number one at Tandia.

To report a lost or stolen MEMBER CARD® debit card during regular business hours, call 1-800-598-2891 after hours please call 1-888-277-1043.