Market Insights

Keep informed about what's happening in the financial markets

Keep informed about what's happening in the financial markets

Data and opinions as of June 30, 2024

It has been two years since the start of the monetary tightening cycle, and it has been a full year where rates are at or above 5% in both Canada and U.S. While economic growth in both countries is starting to moderate, markets have been remarkably resilient. Despite tightening monetary policies, financial conditions remain incredibly easy. Equities, by far led by the U.S., continue to see strong gains in the first half of 2024 with major indices reaching new record highs. Despite some volatility and brief selloffs, such as Nvidia's three-day, 13% plunge, the overall market sentiment remains bullish.

The rally in the U.S. has been narrow, with a few mega-cap companies dominating the gains. The S&P 500 market cap weighted index returned 18% in USD year-to-date, outpacing the equal weighted index by 11%. This concentration of performance in select stocks has raised some concerns about market breadth. Additionally, while U.S. markets thrived, the returns of other global markets were much more subdued, with Euro Area equities and the EUR/USD experiencing heightened volatility due to political events. The S&P/TSX Index has lagged this year, and June was no exception. The index returned 9% YTD, and was down -1.5% in June, weighed down by financials, utilities, energy, communications, and materials.

Bond markets finished the month higher with FTSE Canada Universe Bond Index up 1.3%, bringing the year-to-date return to almost breakeven, only down -0.4%. The Global Aggregate Bond Index also rose 0.8% over the month, the index is also nearly flat YTD, down just -0.2%.

Political regime changes caused volatility with elections in Mexico, India, France, the U.S., and the UK. There were some surprising outcomes and varying market reactions.

Emerging market equities have had a strong month of June and second quarter, outperforming developed markets. This is partially reflected in Taiwan’s economic growth due to the continued strength in demand for, and exportation of semiconductors.

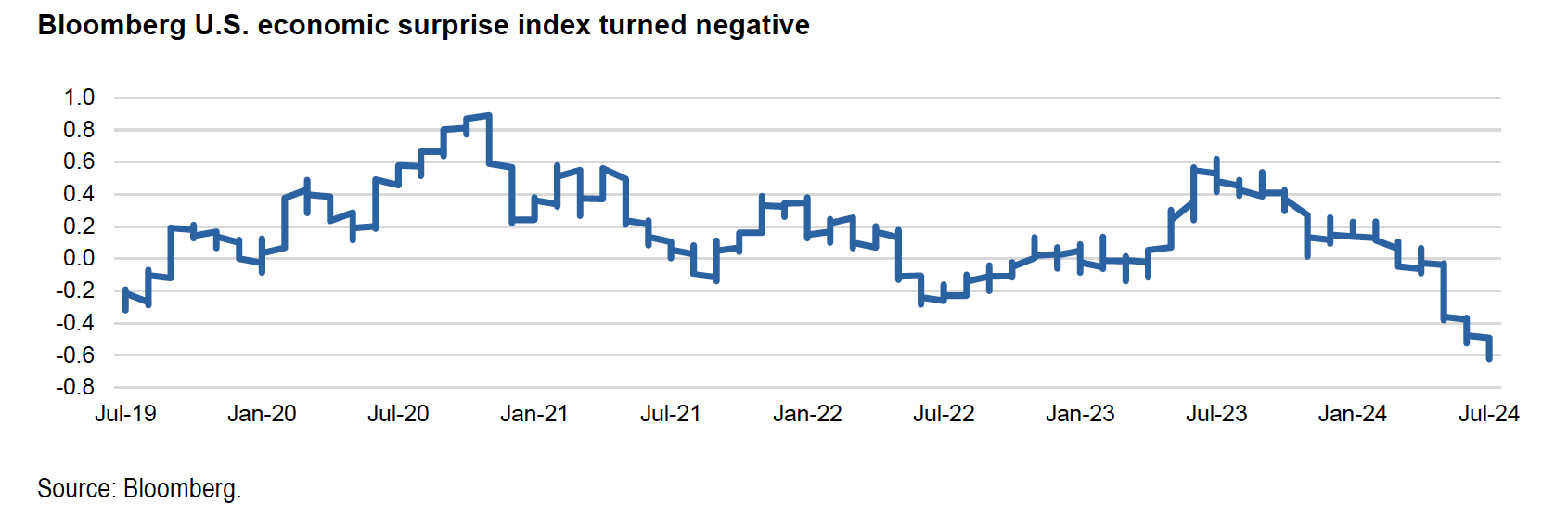

The U.S. economy has been delivering one upside surprise after another since the pandemic but that has started to show signs of slowdown recently as retail sales and consumer confidence are starting to miss expectations.

From NEI’s Monthly Market Monitor for June. Read the Read the full report on NEI’s website for full report for more insights.

June was a busy month on the political front as elections in Mexico, India, France, the U.S., and the U.K. have had some surprising outcomes and varying market reactions:

Bottomline: While political rhetoric can create short-term noise in the markets, it continues to be corporate earnings and fundamentals that are the real drivers of long-term returns. Historical data demonstrates that markets have shown resilience and indifference under both Republican and Democratic administrations. Investors may want to take advantage short-term market volatilities as entry points but should not position their portfolios any differently based on election outcomes.

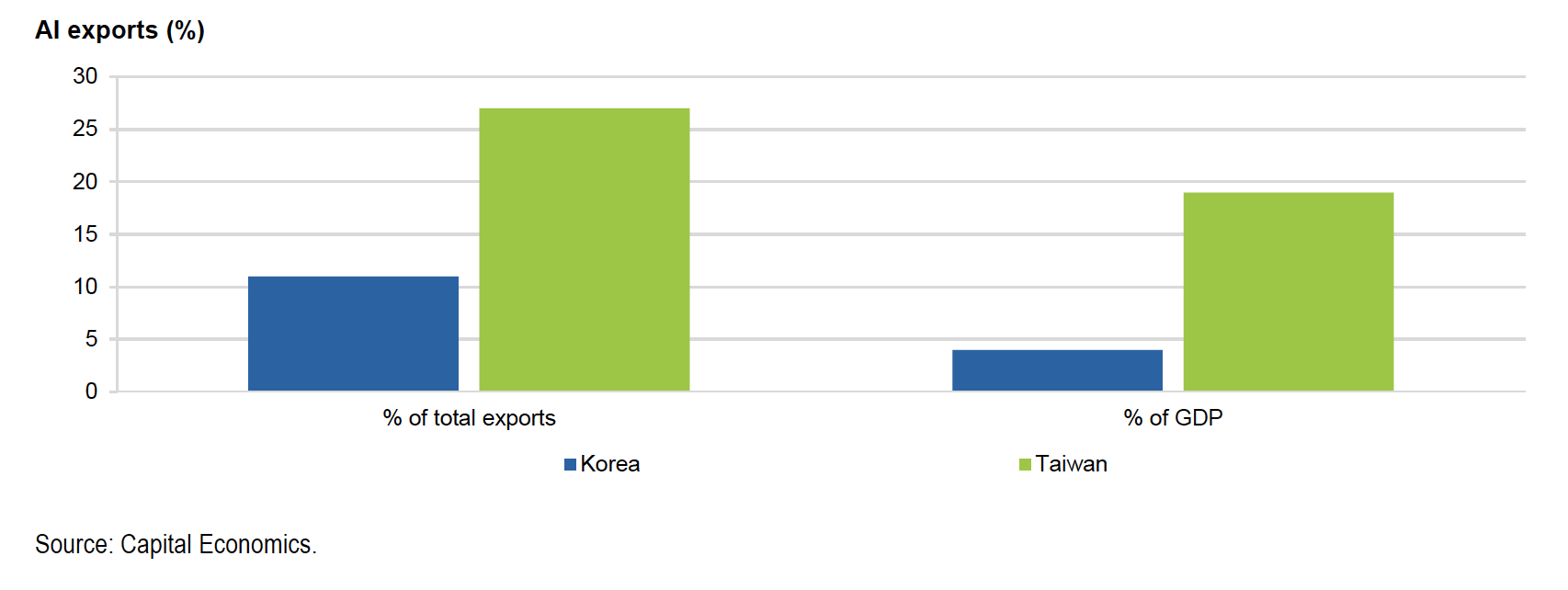

Emerging market equities have had a strong month of June and second quarter, outperforming developed markets. Chinese authorities have been rolling out policies to support the real estate market, which provided a boost to Chinese equity markets. Continued strength in demand for semiconductors is also supporting the Taiwanese equity market, buoying Taiwan Semiconductor Manufacturing Company Limited’s (TSMC) market cap to be over 51% of the MSCI Taiwan Index’s overall market cap. Exports of high-end semiconductors is also boosting Taiwan’s economic growth, where sales of AI-related products account for 27% of Taiwan’s total exports and 19% of GDP in Taiwan.

The U.S. economy has been delivering one upside surprise after another since the pandemic but that has started to show signs of slowdown recently as retail sales and consumer confidence are starting to miss expectations.

The depletion of excess savings, particularly among lower-income groups, is starting to dampen consumer spending, a key driver of the U.S. economy.

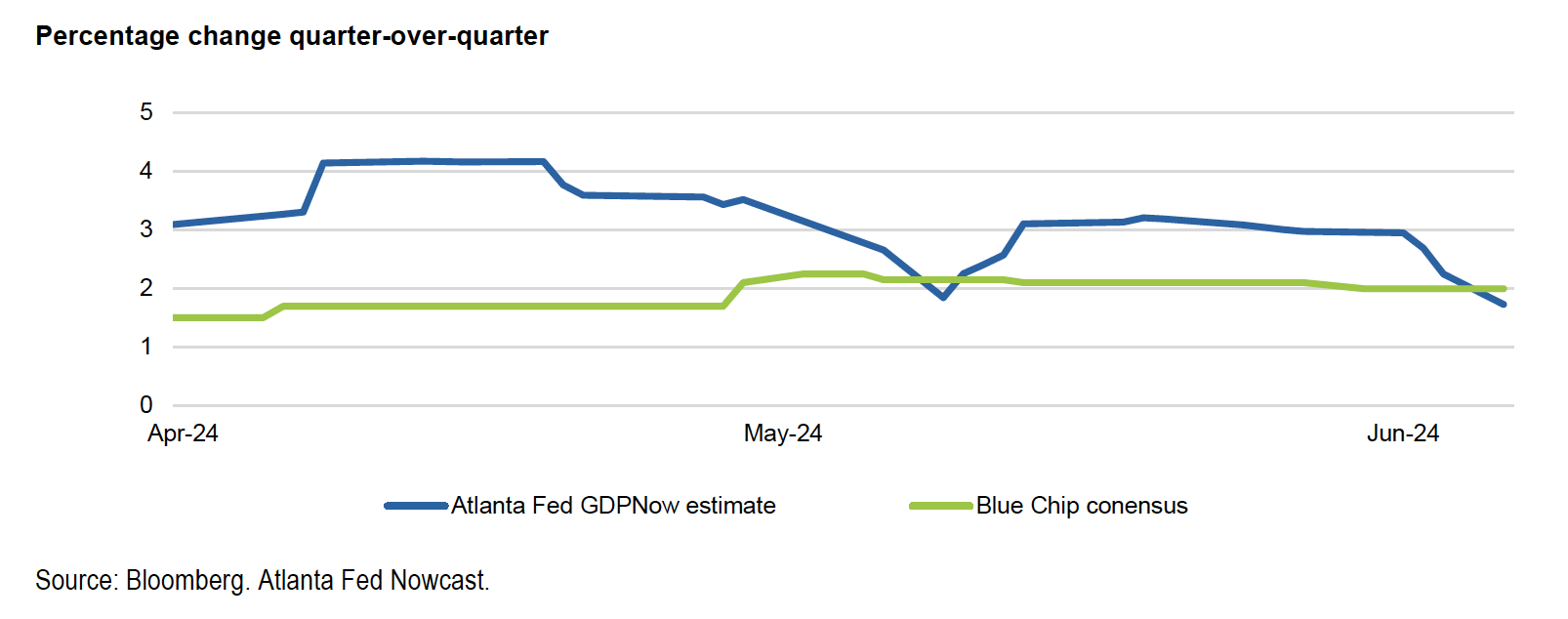

The Federal Reserve Bank of Atlanta (Atlanta Fed) GDPNow forecasting model, a higher frequency measure of economic growth, for Q2 has fallen from 4.2% to 1.8% in 4 weeks. It is now below the consensus estimate for the first time in a long time. Weak manufacturing data fueled speculation that the economy is slowing.

Additionally, the gradual rebalancing of the labour market may further contribute to this slowdown. Data releases on job openings and labour market turnover survey is lagged by a month, but they are important inputs to assess labour market tightness. The April Job Openings and Labor Turnover Survey (JOLTS) data pointed to a continued easing in the labour supply/demand imbalance. This should give the Fed tentative confidence that the labour market is rebalancing and in turn, inflation pressures overall will continue to subside.

Aviso Wealth Inc. (“Aviso”) is the parent company of Aviso Financial Inc. (“AFI”) and Northwest & Ethical Investments L.P. (“NEI”). Aviso and Aviso Wealth are registered trademarks owned by Aviso Wealth Inc. NEI Investments is a registered trademark of NEI. Any use by AFI or NEI of an Aviso trade name or trademark is made with the consent and/or license of Aviso Wealth Inc. Aviso is a wholly-owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited.

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by AFI and unless indicated otherwise, all views expressed in this document are those of AFI. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information. Mutual funds and other securities are offered through Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

Absolutely not, anyone can benefit from solid investment advice! Even if you are just starting out, speaking with a Wealth Advisor about your unique goals and situation is a great way to get started. Having an investment plan in place can help you reach your life goals, like retirement or buying a home, while giving you peace of mind about your investment choices. We can’t all be experts, right? So why not benefit from a little advice and guidance from those that are!

You don’t need to be an expert to know that the Canadian economy has been unpredictable and has a lot of people on edge right now – but why is that, and what exactly does it mean for you? Well, we are here to help you find out! Think of this article as your own personal cheat sheet to help you better understand some of the terms you’ve heard recently, why this is such a hot topic right now and what impact it may have on you.

Money Mindset is a collection of bite size easy to understand articles, tips and resources where we delve into the world of finance, promote financial literacy, and empower individuals to gain a better understanding of their money and how it works.

At Tandia we have a range of investment products that can help you reach your financial goals. We have a full complement of traditional investment products that can be held within or outside of a registered plan.

No matter what stage of life you are in or how much money you have to invest - we are here to work with you and help your savings grow.

Listen to our weekly Podcast that answers all your burning questions about money. We’re here to make money more relatable, with take-action tips to help you create the life you want.

We will help you tackle those financial problems, look at your goals and help you define your financial journey. Start listening!

Our representatives are ready-when-you-are to help with investment questions, advice and solutions. We can meet you where and how you want to meet. We are available by email, by phone, in person, or by video conferencing.

Get in touch with us at any time, whether it’s a question about our services or a comment on how we can do things better. Your voice is number one at Tandia.

To report a lost or stolen MEMBER CARD® debit card during regular business hours, call 1-800-598-2891 after hours please call 1-888-277-1043.